Business Solutions

Making Tax Digital

Empowering Efficiency, Elevating Productivity: Unleashing the Future with Seamless Process Automation.

Request a meetingUnleashing the Future with Seamless Process Automation.

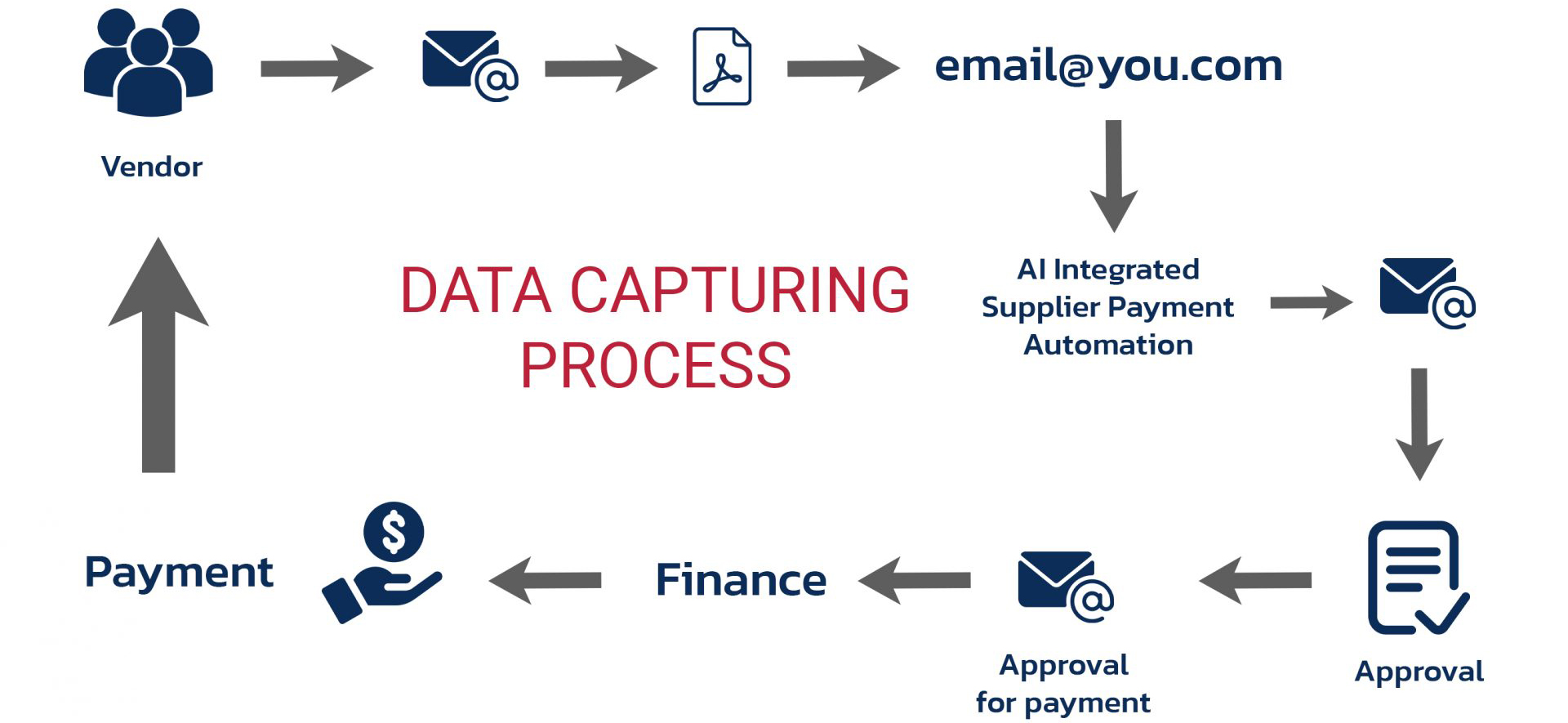

Our AI Integrated Supplier Payment Automation has been designed to automate parts of the manual Accounts Payable process and it can capture data from invoices automatically and send for processing. This system has following capabilities.

- Capture values of PDF invoices using a machine learning algorithm.

- Eliminate data entry delays using automatic recognition.

- Automatically trigger electronic invoice verifications and authorizations.

- Manually enter invoices if required.

- Report generation and export reports as CSV file.

- Admin module to control system operations.

- Alerts to notify pending actions

Why AI Integrated Supplier Payment Automation?

Efficient Approval process.

Paperless.

Cost reduction by removing manual processing.

Supplier notifications when payment is made.

Helpful dashboards showing invoices overview.

Audit Trail for all activities within the system.

Integrate with banking and finance solutions like SAP and Sage.

Other Solutions

Let’s Talk

Let’s talk next steps towards your accelerated growth.